Using your Mortgage Refinance to Repair your Credit History

Your Mortgage Refinance can be used to consolidate debts, payoff creditors and taxes, and start the process of reestablishing your credit history.

Did you Know?

Each time a payment on a credit card, loan, line of credit, and other debts is missed or late, a mark is added to your credit bureau which will be viewed each time you apply for credit for a minimum of 6 years! These late payments will affect your ability to obtain credit in the future, and will lead to higher interest rates.

Some other situations that can hurt your credit include being over limit (for instance if you have a $5000 credit card with a balance of $6000). Bankruptcy, Consumer Proposal, Late Mortgage Payments, Judgments and Collections. Last but not least, too many credit checks (for example if you are car shopping and each dealership pulls your credit report). There is speculation that each time your credit report is pulled, you lose 5 points. If you visit 15 car dealerships and each time your credit is pulled, that may cost you 75 points from your score!

So what is a good score?

There are two items that are considered when looking at a credit score.

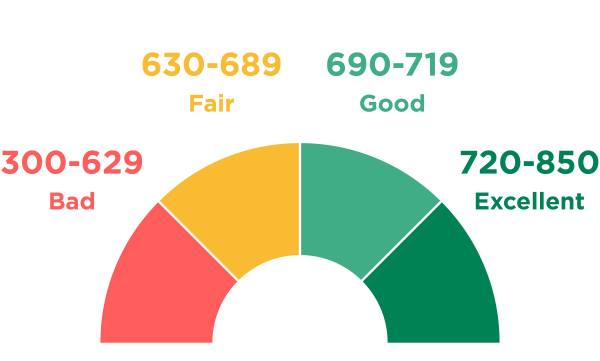

First, the score

Under 629 - Poor

630-689 - Fair

690-719 - Good

Over 720 - Excellent

Second, the history

Say for example you just got your first credit card and use it for 6 months without missing any payments, you may have a score of 700. But that is a fairly weak credit report, compared to someone who has 20 years of credit history with the same 700 score.

How do we help?

We are very experienced at reading credit reports, and it takes a keen eye to be able to tell what is damaging a credit report the most. Sometimes it may be that a client is just over limit, and we need to pay down some debt. Other times it may be more complicated, if collections, judgments, liens, bankruptcy or other serious problems are detected. Or it could be there is just too little credit. For any of these scenarios we can help.

-Paying down debt through a debt consolidation mortgage

-Paying off liens, collections, bankruptcy, CRA taxes, property taxes and Judgments

-Helping to reestablish credit after the mortgage, with secured VISA's that report to the bureau

-Paying off a consumer proposal using the mortgage to jump start the credit repair process

Lower Rates Sooner

By paying off debts, collections, consumer proposals, bankruptcy and any other kind of debt your credit will start regaining lost points immediately. Depending how broken the credit is, the interest rates may be higher for a few years, but often pale in comparison to the interest rates being charged on credit cards, consumer proposals, credit aid services and more. We look at it as a little bit of short term pain, for a long term gain. We don't believe in bandaid solutions, we want a long term plan that works!

Do any of these situations look like yours?

Whether you have perfect credit, or have serious credit issues, we can help.

Let's Begin by filling out our Mortgage Application or Contact Us Form below

Still want more information? How about reading about.....

Debt Consolidation Scenarios How 2nd Mortgages Work